GM Properties Facilitates High-Value Retail Sale Through Strategic Lease Negotiation

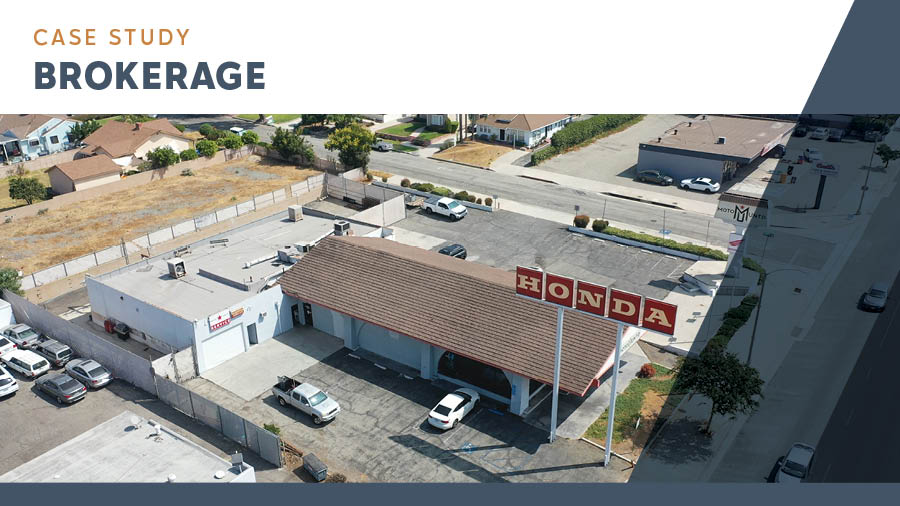

In September 2024, GM Properties’ brokerage team—Dustin Wheelan, Tyler Portman, and Ben Greer, Vice Presidents of Brokerage—was engaged to sell a ±6,700 SF retail building at 14043 Whittier Blvd. The seller, who had inherited the property through a trust, was motivated to sell quickly and aimed to close by year-end. With just three months to list, secure a buyer, and close escrow, GM Properties needed to act quickly and strategically to meet this deadline.

GM PROPERTIES’ STRATEGIC APPROACH

Upon evaluating the property, GM Properties identified a key obstacle: a long-term, below-market ground lease with the existing tenant, Moto United—a powersports dealership specializing in ATVs, motorcycles, and jet skis. The dealership had occupied the property for decades and had installed a large water tank on-site for product testing.

A market analysis revealed that selling the property vacant would attract stronger offers, opening the opportunity for a developer or owner-user to purchase the site.

To position the property for maximum value, GM Properties:

- Negotiated a lease termination agreement with the tenant, ensuring a smooth transition while maintaining the sales timeline.

- Listed the property in early October 2024, immediately generating high market interest.

- Received six offers within two weeks, demonstrating the property’s desirability and strong pricing strategy.

While residential developers offered above-asking prices, their proposals required lengthy contingencies and city permitting processes that could delay the sale for a year or more. To minimize risk, the seller opted for certainty of closing, and selected a qualified buyer with a standard escrow timeline—allowing the transaction to close before Thanksgiving, well ahead of the seller’s year-end goal.

RESULTS & CLIENT BENEFIT

The property’s successful and expedited sale was driven by GM Properties’ proactive lease termination strategy, which repositioned the asset as a more attractive investment. The sale also capitalized on Whittier’s ongoing zoning shifts and revitalization along Whittier Blvd., where available development sites are rare.

This transaction underscores GM Properties’ expertise in navigating complex lease negotiations, market analysis, and risk mitigation to maximize value for sellers. The final sale not only exceeded the seller’s timeline expectations but also resulted in a higher-than-anticipated sale price in a highly competitive market.

_______________________